property tax on leased car in texas

Lease payments are not taxed in Texas. All leased vehicles with a garaging address in Texas are subject to property taxes.

Buy Or Lease Your New Business Vehicle The Turbotax Blog

In Texas only income-producing tangible personal property is subject to personal property tax.

. How are car leases taxed in Texas. This could include a car which in most households is a relatively valuable property. For example in Alexandria Virginia a car tax runs 5.

2 Leases subject to use tax. Motor vehicle means a passenger car or light truck as defined by Transportation Code Section 502001. When I leased my vehicle I filled out the affadavit that states I should not be charged property taxes because the vehicle is for personal use not for business.

Using our Lease Calculator we find the monthly payment 59600. In Texas all property is taxable unless exempt by state or federal law. This affidavit must be completed by the person leasing the vehicle.

This application is for use in claiming a property tax exemption for one motor vehicle used for both the production of income and personal non-income producing activities pursuant to Tax Code Section 11254. Credit will be given for any tax the lessor or the lessee paid to another state. The vehicle may be registered in the lessors name and still qualify for the new resident tax as long as the new resident is named as the lessee under the lease agreement.

Since leased vehicles produce income for the leasing company and are taxable to the leasing company. Motor Vehicle Leased Outside Texas by Texas Resident - Titled to Leasing Company. There are some available advantages to leasing a vehicle in a business name please consult your tax.

25000100 0615375 15384. The standard tax rate is 625 percent. The tax bills are sent to the leasing companies in the following October and the bills are due by the following January 31st.

In Texas all property is taxable unless exempt by state or federal law. January 1 of each year. Property taxes on the vehicle are not applicable for the lessee.

The standard tax rate is 6 14. If personal property taxes are in effect you must file a return and declare all nonexempt property as well as its value. In our example the vehicles cost is 30000 the lease term is 36 months residual value is 15000 and interest rate is 65 money factor.

Our Texas lease customer must pay full sales tax of 1875 added to the 30000 cost of his vehicle. How is the tax amount determined. For tax year 2014 the tax rate was 0615375 per 100 of valuation.

The tax is levied as a flat percentage of the value and it varies by county. For tax year 2016 the tax rate was 0612875 per 100 of valuation. Conversely you can back into the vehicles value from the tax amount by dividing the tax.

In Texas all game is taxable unless overcome by holding or federal law Property taxes on the pearl are not applicable for the lessee Since leased vehicles produce both for the leasing company store. This affidavit is used in claiming tax property tax exemptions for motor vehicles leased for use other than production of income pursuant to Tax Code Section 11252. In order to meet the property tax codes definition of income-producing a vehicle must drive more than 50 percent of its miles for activities that involve the production of income within a tax year.

All personal use vehicles are exempt from county and school taxes. So for example for a vehicle valued at 25000 the tax is calculated as. The lessor pays 625 percent motor vehicle sales tax when the vehicle is purchased and titled in Texas.

Lets say you leased a BMW 320i sales price is 33000 and your lease over 27 months totals 10000 Dollars then youd be responsible for sales tax of 625 on 10000 or 62500. Tax will be due on the total amount of the contract regardless of where the property received in Texas is used during the lease. But some cities in Texas charge personal property taxes on leased vehicles.

Do I owe tax if I bring a leased motor vehicle into Texas from another state. EXCEPT in Arkansas Illinois Maryland Oklahoma Texas and Virginia where you pay sales tax on the. When a motor vehicle is leased in another state and the lessee is a Texas resident or is domiciled or doing business in Texas and brings the motor vehicle into Texas for use the lessee as the operator owes motor vehicle use tax.

The taxable value of private-party purchases of leased used motor. In February I was charged 496 which is the amount quoted for the entire term of the lease if I was to be charged which Im not supposed to have been. See motor vehicle sales tax rule 370 for additional.

When a vehicle is leased in another state and the lessee brings it to Texas for public highway use the lessee as the operator owes motor vehicle use tax based on the price the lessor paid for the vehicle. Do I have to pay personal property tax on a leased vehicle in Texas. In many leasing contracts companies require their lessees to reimburse them for taxes assessed on the vehicles.

Appraisal District Name Tax Year GENERAL INFORMATION. Credit will be given for any tax the lessor or the lessee paid to. If a new Texas resident brings a leased motor vehicle into Texas the new resident owes the 90 new resident tax.

In most states you only pay taxes on what your lease is worth. The tax amount is based on the Citys current property tax rate applied to the value of vehicle. The Texas Legislature has passed an exemption of leased vehicles primarily used for non-business personal purposes.

MOTOR VEHICLES LEASED FOR USE OTHER THAN PRODUCTION OF INCOME Please read Property Tax Code Section 11252 for all details on this legislation. When a vehicle is leased in another state and the lessee brings it to Texas for public highway use the lessee as the operator owes motor vehicle use tax based on the price the lessor paid for the vehicle. Property taxes on the vehicle are not applicable for the lessee.

Since leased vehicles produce income for the leasing company and are taxable to the leasing company. Property brought or shipped into the state for use under the terms of a financing lease or an operating lease will be presumed to be subject to use tax. Property tax rate applied to the value of vehicle.

I thought the law was changed several years ago to exempt personal.

Leasing A Car What Fees Do You Pay At The Start Of A Lease Autotrader

Leasing Vs Financing A Car 9 Questions To Ask Geico Living

/GettyImages-185274181-80022fa82eed40ff80bf97b745b9320c.jpg)

Buying Vs Leasing A Car Pros And Cons Of Each

Is Leasing A Car A Good Idea Experian

Can I Convert My Car Lease To Finance

Should You Make A Down Payment When You Lease Edmunds

Is It Better To Buy Or Lease A Car Taxact Blog

You Can Sell Your Leased Car For A Profit Here S How Much Yaa

How To Lease A Car In 7 Steps And When Leasing Is A Good Idea Thestreet

What Is Residual Value When You Lease A Car Credit Karma

Myths And Facts About Smoking In A Leased Vehicle Below Invoice

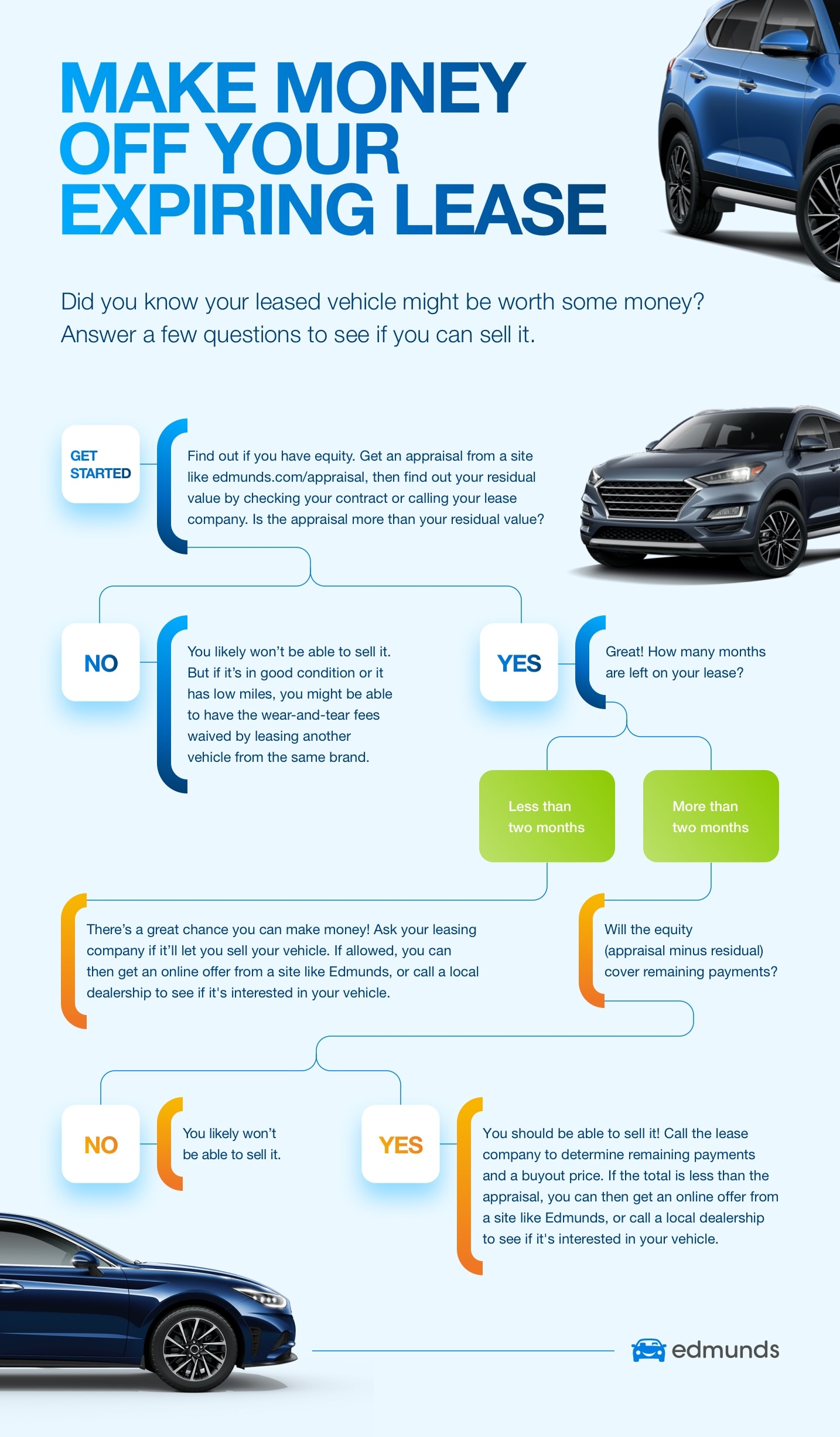

Consider Selling Your Car Before Your Lease Ends Edmunds

Can I Move My Leased Car Out Of State Moving Com

Car Leasing Costs Taxes And Fees U S News

How Do I Sell My Leased Car To A Third Party

Car Lease Calculator Get The Best Deal On Your New Wheels Nerdwallet

What To Do Before Returning A Leased Car Tips To Save Time And Money

Myths And Facts About Smoking In A Leased Vehicle Below Invoice

/GettyImages-129302930-58b0f6f55f9b5860463fea95.jpg)